November 21, 2013 --The global semiconductor market has grown 4% for the first three quarters of 2013 compared to a year ago, according to World Semiconductor Trades Statistics (WSTS). Guidance for 4Q 2013 revenue change versus 3Q 2013 varies widely for key semiconductor companies. Texas Instruments (TI), Broadcom, Infineon and Renesas all expect declines ranging from 7% to 10% based on the midpoint of their guidance. Intel, Qualcomm, STMicroelectronics (ST) and Advanced Micro Devices (AMD) guide toward flat or low single digit growth. Micron Technology did not provide specific revenue guidance, but provided estimates of DRAM and flash Memory bit growth and price changes for their quarter ending in late November. Based on the Micron guidance, Semiconductor Intelligence estimates revenue growth of 30%. Samsung did not provide revenue guidance, but expects solid demand and a tight market (meaning higher prices) for both DRAM and flash memory. Based on the table below, the 4Q 2013 semiconductor market should be flat or up low single digits from 3Q 2013. Thus full year 2013 growth should be 5% to 6%.

| Key Semiconductor Company Revenue Guidance |

| 4Q 2013 versus 3Q 2013 |

| Company | Low end | Midpoint | High end |

| Intel | -2% | 2% | 5% |

| Qualcomm | -3% | 2% | 6% |

| TI | -12% | -8% | -4% |

| Micron | | 30%* | |

| ST | -4% | 0% | 4% |

| Broadcom | -11% | -8% | -5% |

| Renesas | | -10% | |

| Infineon | -9% | -7% | -5% |

| AMD | 2% | 5% | 8% |

| *estimate based on bit growth and price guidance |

What will be semiconductor market growth in 2014? We at Semiconductor Intelligence expect growth to accelerate from 2013 to 2014. One major factor driving the acceleration is the expectation of increasing global GDP growth in 2014. The table below shows the International Monetary Fund (IMF) November 2013 forecast for GDP growth. The IMF expects World GDP growth to accelerate from 2.9% in 2013 to 3.6% in 2014. Advanced economies are forecast to grow 2.0%, up from 1.2% in 2013. The key drivers in advanced economies are the U.S., with GDP growth accelerating by one percentage point, and the Euro Area, which should move from a 0.4% decline in 2013 to 1.0% growth in 2014. Developing Economies are projected to grow 5.1% in 2014, up from 4.5% in 2013. China is forecast to have slightly lower growth in 2014 than in 2013, but other developing economies such as India, Mexico, Russia, Eastern Europe and Southeast Asia are all expected to see accelerating growth in 2014.

Real GDP Annual Percent Change

(IMF, November 2013) |

| Region | 2013 | 2014 |

| World | 2.9 | 3.6 |

| Advanced Economies | 1.2 | 2.0 |

| U.S. | 1.6 | 2.6 |

| Euro Area | -0.4 | 1.0 |

| Japan | 2.0 | 1.2 |

| Developing Economies | 4.5 | 5.1 |

| China | 7.6 | 7.3 |

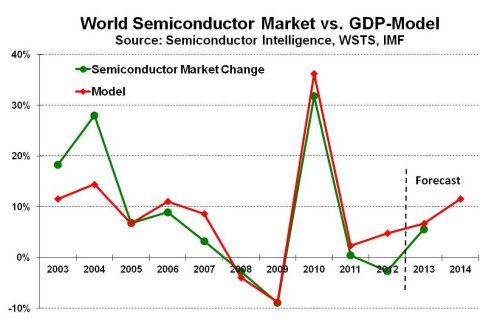

Many factors affect the semiconductor market, but GDP growth is a key element. The components of GDP include business investment and consumer durable goods spending – both major drivers of semiconductors. We at Semiconductor Intelligence have developed a proprietary model of semiconductor market growth based on changes in GDP. The model is illustrated below for 2003 to 2014. The model is generally accurate in predicting the acceleration or deceleration of the semiconductor market. The only exception in the last 10 years is 2012, when the model predicted slight acceleration in semiconductor market growth while the market actually declined. In six of the last ten years the model has been within a couple of percentage points of the actual market change. Based on the IMF forecast of 3.6% GDP growth in 2014, the model predicts semiconductor market growth of 12%. Of course the accuracy of the model is dependent on the accuracy of the GDP forecast.

In November 2012 Semiconductor Intelligence forecast semiconductor market growth of 9% in 2013 and 12% in 2014. In May 2013 we revised this to 6% in 2013 and 15% in 2014. We are continuing to hold to this forecast. As stated earlier, 2013 will probably finish with 5% to 6% growth. Although the model calls for 12% growth in 2014, we believe there is upside potential for GDP and semiconductor market growth.

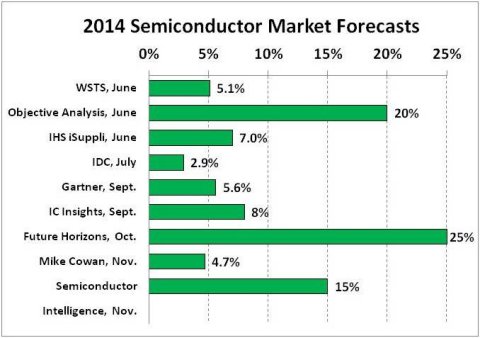

How does our 15% growth for 2014 compare to other semiconductor market forecasts? The optimists are Objective Analysis and Future Horizons. In June Jim Handy of Objective Analysis projected 2014 growth of over 20%. Malcolm Penn of Future Horizons recently called for 25% growth. Other forecasters expect 2014 growth to be similar to 2013, ranging from 2.9% from IDC to 8% from IC Insights.