MPU and DRAM round out top three product categories in $143 billion China IC market.

February 18, 2021 -- IC Insights recently released its 2021 edition of The McClean Report. The new analysis and forecast of the IC industry includes an analysis of regional marketshares, including a split of the China IC market by product type.

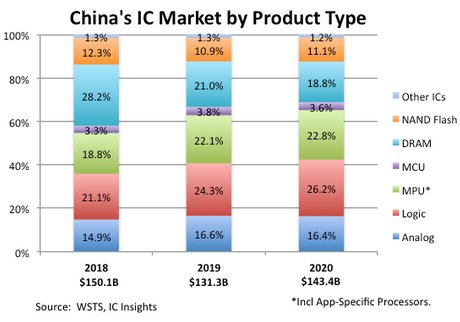

China became the largest IC market in the world in 2005 and has continued to grow in size since then. In 2020, the Chinese IC market increased to $143.4 billion, a 9% gain from $131.3 billion in 2019. IC Insights estimates that 60% ($86.0 billion) of China’s $143.4 billion IC market was integrated into an electronic system that was exported while 40% of its IC market ($57.4 billion) was used in systems that remained in the country. Figure 1 shows the split of China’s IC market by product type. Leading the way were sales of logic devices, which accounted for 26% ($37.5 billion) of China’s IC market last year. IC Insights forecasts the logic market will remain China’s largest IC product segment through 2025, maintaining a strong CAGR of 10.5% through the forecast period.

Figure 1

Strong sales of smartphones in China and throughout the world along with an uptick in sales from various computing systems during the virus-plagued year resulted in microprocessors being the second-largest IC product segment in China last year. MPU sales in China, including revenue from application-specific processors, grew 12% in 2020 to $32.7 billion.

With 19% share, DRAM was the third-largest IC market in China last year. In 2020, the DRAM and NAND flash memory markets together accounted for 30% of China’s total IC market. The high level of memory consumption in China is helping fuel the country’s burning desire to create an increasing amount of indigenous production of both DRAM and NAND flash devices.

There is no denying the long-term trend toward increasing IC marketshare in China and the rest of the Asia-Pacific region. China and Asia-Pacific are forecast to increase their combined share of the worldwide IC market from 63.8% in 2020 to 68.1% in 2025, which represents a CAGR of 9.4% over this time period.

While China has been the largest consuming country for ICs since 2005, the nation is not necessarily a major producer of ICs now, and it may not be in the future. Of the $143.4 billion worth of ICs sold in China in 2020, only 15.9%, or approximately $22.7 billion, of it was produced in China last year. Of that amount, China-headquartered companies produced only $8.3 billion, accounting for only 5.9% of the country’s total IC market last year. Foreign companies with wafer fab operations in China (e.g., TSMC, SK Hynix, Samsung, UMC, etc.) still account for much of China’s IC production.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/